Fraud & Scam Alerts

Stay updated on recent alerts.

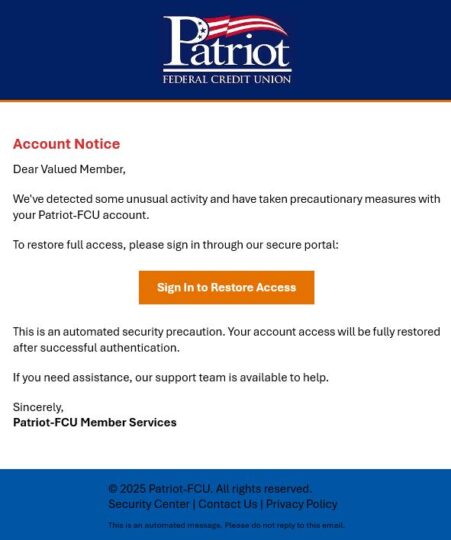

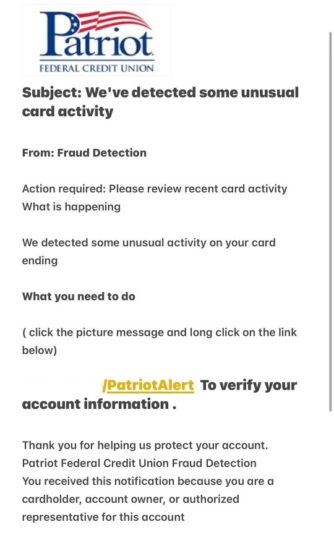

Important Alert: Beware of Fraudulent Emails

We’ve received reports that some Patriot members are receiving emails claiming to be from Patriot, asking about unrecognized transactions, and requesting their username and password to log in and validate the activity.

Please be aware:

Patriot will never ask you to log in to verify transactions, nor will we ever ask for your username or password.

If you receive a suspicious message:

- Do not click any links.

- Do not enter your username or password.

- Block the number immediately.

If you’re ever unsure about a message, contact us directly through our official channels. Keeping your information safe is our top priority.

Exercise caution and be mindful, as scams are prevalent through various channels, including mail, email, phone calls, and text messages.

For more information on common fraud schemes and ways to avoid becoming a victim, visit the FBI’s website: fbi.gov/scams-safety/fraud/fraud.

Consumers can easily report fraud and all other consumer issues directly to the Federal Trade Commission’s (FTC) website:

To report fraud to FTC: ReportFraud.ftc.gov

To report identity theft to FTC: Identitytheft.gov

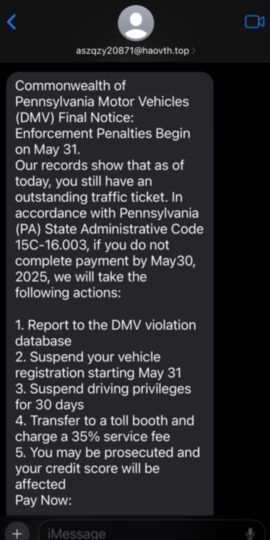

We have received multiple reports of individuals receiving fraudulent text messages claiming to be from the Pennsylvania Department of Motor Vehicles (PA DMV). These messages often mimic official court communications and allege that the recipient has an outstanding traffic ticket. The texts typically include a link to a fake website resembling the official PA Courts site, urging immediate payment to avoid severe penalties.

Please be aware that the Administrative Office of Pennsylvania Courts will never contact individuals via text message to solicit payment for fines or fees. If you receive such a message, do not click on any links or provide any personal information. Instead, report the message to the Pennsylvania Office of Attorney General at scams@attorneygeneral.gov or call 1-800-441-2555.

We have received multiple reports of employees, members, and non-members receiving the text messages shown below. In each case, the text was a group message with 9-10 recipients.

These are fraudulent texts and are NOT from Patriot’s Fraud Department. Please report and block the numbers.

The National Credit Union Administration has received consumer calls about a suspicious text message claiming to come from the agency. The message reads: “National Credit Union Administration Alert for (recipient’s phone number). Contact 844-234-5445.” This is not a communication from NCUA. The agency does not seek personal information through internet or on the telephone. Please contact NCUA’s Consumer Assistance Center at 1-800-755-1030 between 8 am and 5 pm Eastern if you receive one of these messages. NCUA also recommends contacting your credit union and local law enforcement.

Voice phishing (commonly referred to as vishing) is the criminal practice of using social engineering over the phone to gain access to victims’ personal and financial information (credit card number, account number, PIN number, security code number, etc.) in order to defraud them. The fraudsters can be a live person OR vishing can be done by robocall. Either way, the objective is to use clever techniques to defraud unsuspecting individuals.

The sole intention of the call is to scam people out of their hard-earned money, by pretending to be financial institutions, law firms, investigators, federal agencies, or debt collectors. And since fraudsters constantly vary their scams, it is important to constantly beware of text messages, emails, and telephone calls or recordings requesting confidential data.

Here are some tips to keep in mind:

- Do not trust the caller ID on your phone. Scammers use technology to change the caller ID to any number.

- Be suspicious of all unsolicited phone calls, texts and emails.

- Never respond to any telephone call or text requesting personal or financial information.

- Take caution when visiting social network sites and sharing personal information.

Be assured that Patriot, law firms, investigators, federal agencies nor debt collectors will not seek personal information from consumers over the phone. If you believe someone has attempted to scam you in the manner described above, immediately contact Patriot at our Contact Center phone line, 888-777-9982.

If you receive an automated, recorded call that your debit card has been suspended due to a compromise, this is a fraud. These calls are not being initiated by Patriot or any other financial institution. The recording is asking members to press 1 and enter their account number. Never respond or provide any personal information by phone or online. Patriot will never send a text, email or phone call that asks you to provide card or account information.

Here are more details about this type of scam

A credit union recently reported receiving hundreds of calls from members and nonmembers saying they received a phone call on their landline or cell phone with an automated message indicating their account may be locked or closed, or their card numbers were compromised. The victims were asked to enter their credit or debit card number.

Awareness about this type of a scam is critical to prevent your accounts from being compromised by this version of vishing (voice phishing). Again, you should never respond to these calls by providing the requested personal or financial information – no matter how urgent the message may seem. Please remember:

- Never respond to any telephone call requesting personal or financial information.

- Take caution when visiting social network sites and sharing personal information.

- If you receive this type of call, report it to the following:

- Credit union

- Federal Trade Commission (1-877-382-4357)

- State attorney general

- Local law enforcement

- Phone carrier – landline or cell phone provider.

- If you slip up and respond to such a call by providing account or card information, notify Patriot to close or block your accounts to prevent fraudulent transactions.

- And, if you slip up, and provide the requested information during the call, contact one of the three credit bureaus to place an “initial fraud alert” on their credit report.

Two members reported receiving text messages “from their credit union” to call an automated service. When the call was placed to this number, an electronic verification service recording explained that the callers’ credit card has been restricted and to enter their 16-digit card number in order to un-restrict their card.

You can be sure the text was not from Patriot Federal Credit Union. You should never provide any information to an unknown source.

Sending money to unfamiliar individuals or disclosing personal and financial details to unknown callers increases the risk of falling victim to telemarketing fraud. Look out for these warning signs:

- Urgent pressure tactics, such as claims that the offer is time-sensitive.

- Offers of “free” gifts, vacations, or prizes that require payment for fees like postage and handling.

- Requests for immediate payment, credit card or bank information, or check collection without sufficient time for consideration.

- Discouragement from verifying the company with family, legal counsel, or consumer protection agencies.

- No provision of written information about the company or references.

If a telemarketer uses these lines or similar ones, politely decline and hang up.

Follow these tips to avoid telemarketing fraud:

- Avoid buying from unfamiliar companies; seek information and verify legitimacy.

- Wait for written materials about offers or charities before committing.

- Check unfamiliar companies with consumer protection agencies, Better Business Bureau, or similar organizations.

- Obtain detailed information about the salesperson and the business before transacting.

- Ask for advice from trusted sources before making decisions on significant investments or charitable contributions.

- Avoid paying in advance for services; pay only after they are delivered.

- Be cautious of companies sending messengers to pick up money, as it may be a scam.

- Take your time to make decisions; legitimate businesses won’t pressure you.

- Question offers you don’t fully understand and never give out personal information to unknown entities.

- Be aware that personal information may be brokered to telemarketers through third parties.

- Report fraud to law enforcement agencies if victimized.

Advance fee schemes involve victims paying money in anticipation of receiving something more valuable, such as a loan, contract, investment, or gift, only to receive little or nothing in return. Con artists can employ various schemes, including product or service sales, investment offers, lottery winnings, and more. They might promise financing arrangements for a fee but may not intend to provide financing.

To avoid falling victim to these schemes:

- If an opportunity seems too good to be true, it likely is. Legitimate business is not typically conducted in cash on a street corner.

- Verify the identity of unfamiliar individuals or companies before doing business with them. Check with the Better Business Bureau, visit their location, or consult with trusted sources.

- Understand the terms of any business agreement; seek legal advice if needed, especially for complex terms.

- Exercise caution with businesses operating solely from post office boxes, lacking a street address, or those with no direct telephone line.

- Be cautious of deals requiring nondisclosure or non-circumvention agreements, as they may hinder independent verification and be used by con artists to discourage reporting to law enforcement.

Healthcare Fraud Warning Signs:

- Medical Equipment Fraud:

- Manufacturers offer “free” products to individuals, and insurers are billed for unnecessary or undelivered products.

- “Rolling Lab” Schemes:

- Unnecessary tests are conducted at health clubs, retirement homes, or malls and charged to insurance companies or Medicare.

- Services Not Performed:

- Billing insurers for services never rendered by altering or submitting fake bills.

- Medicare Fraud:

- Targets seniors, especially by offering free medical products in exchange for Medicare numbers.

- Con artists fake signatures or bribe doctors to certify the need for equipment or testing.

- Manufacturers then bill Medicare for unnecessary or unordered merchandise or services.

Tips to Avoid Health Care Fraud:

- Never sign blank insurance claim forms.

- Avoid giving blanket authorization to medical providers to bill for services.

- Inquire about costs and out-of-pocket expenses before receiving medical services.

- Review insurer’s benefit statements carefully and contact them or providers with questions.

- Be cautious of door-to-door or phone salespeople claiming free medical services or equipment.

- Only provide insurance/Medicare details to those who provided medical services.

- Keep accurate records of healthcare appointments.

- Know if your physician ordered equipment for you.

Prime Bank Note Fraud: Fraudsters offer high-yield investments in “roll programs” involving supposed bank guarantees from “prime banks.” Legal documents often include non-disclosure agreements and false claims of ICC approval. Victims are coerced into sending money to foreign banks, resulting in personal expenses for the fraudster.

Tips to Avoid:

- Be cautious of high-yield schemes involving “prime banks.”

- Perform due diligence on the investment, verifying identities and security existence.

- Avoid deals with non-disclosure agreements hindering independent verification.

Ponzi Schemes: These schemes promise unrealistic returns, using new investors’ funds to pay dividends to earlier ones. The scheme collapses when the operator absconds or when new investors can’t sustain payouts.

Tips to Avoid:

- Beware of exaggerated earnings claims.

- Conduct due diligence before investing.

- Consult an unbiased advisor before making investment decisions.

Pyramid Schemes: Victims are induced to recruit others to earn recruitment commissions, focusing on selling distributorships rather than the product. The pyramid collapses when recruitment potential is exhausted.

Tips to Avoid:

- Be cautious of investments requiring recruiting for profit.

- Verify the legitimacy of franchises or investments independently.

Market Manipulation or “Pump and Dump” Fraud: This scheme artificially inflates a security’s price through deceptive practices, with fraudsters selling off shares at the inflated price. Foreign hackers may gain unauthorized access to online brokerage accounts for coordinated purchases.

Tips to Avoid:

- Be skeptical of exaggerated claims.

- Research where the stock trades.

- Independently verify information and claims.

- Beware of high-pressure sales tactics.

- Maintain a skeptical mindset.

Disclosures

-

This credit union is federally insured by the National Credit Union Administration.

-

Equal Housing Lender